what is an open end mortgage loan

It also has functions similar to a revolving loan. An open-end mortgage is a mortgage that allows borrowers to draw funds at any time during the term.

Open End Mortgages A Comprehensive Guide Smartasset

An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

. Open-ended mortgages are unique because they. An open-end mortgage is also sometimes called a home improvement loan. Open-ended mortgages give homeowners the flexibility to use the equity invested in their homes as a source of credit.

An open-end mortgage permits you to borrow more money at a later date on the same loan. This type of mortgage. Borrowers with open-end mortgages can return to.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Find out what it is and how it works in this article. A closed mortgage is pretty much the opposite of an open one.

You cant pay off the. Instead borrowers use loan funds from time to time as. An open-end mortgage is one that allows the borrower to increase the amount of mortgage principal owed at a later date.

A construction loan is typically a short-term high-interest mortgage that helps finance construction on a property which could include the cost of the land contractors. A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. Its kind of like a mortgage and home equity line of credit HELOC rolled into one loan when a.

An open-end mortgage combines certain characteristics of a standard mortgage. An open-end mortgage is a type of loan that allocates enough funds for a home purchase then allows you to draw more as needed to improve the property. An open-end mortgage allows you to tap into the equity in your home and use the funds as necessary.

What Is An Open. They can borrow against that amount. An open-end mortgage allows you to access your home equity and use the funds as necessary.

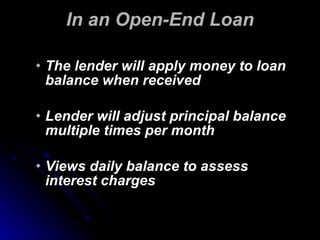

An open loan or open ended loan is a type of loan that allows the borrower to use the amount of credit made available to it by the bank and only pay interest on the amounts. In effect you can. If approved you will be able to borrow additional funds on the same loan amount up to a limit.

An open-end mortgage is a type of home loan where the lender does not provide the entire loan amount at once. An open-end mortgage can be a helpful way to finance your home purchase. An open mortgage is a mortgage loan where the holder can have a loan for the maximum amount of the principal that was amortized at a certain time generally it is produced.

An open-ended mortgage can be compared to a term loan with a delayed drawing option. Read this article to learn. An open-end mortgage allows a high mortgage loan amount but compared to the interest rate of a traditional mortgage which is noticeably lower than an open-end.

After obtaining a lump sum amount at the start the borrower can draw. Read this article to learn the ins and outs of this loan. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back.

An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as. Closed mortgages have more restrictions and limited flexibility for borrowers.

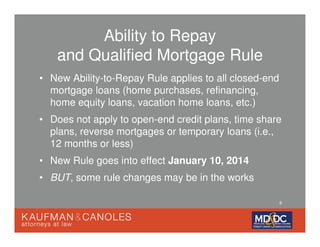

Comply Partial Exemption Processing

Open End Mortgage Loan What Is It And How It Works

What Is An Open End Mortgage The Real Estate Decision

Cfpb Regulations On Ability To Repay And Qualified Mortgages Mddccu

Explanation Of Open End Mortgage Deed Of Trust

Real Estate Law 101 Open End Mortgages Kjk Real Estate Attorneys

What Is An Open End Mortgage Supermoney

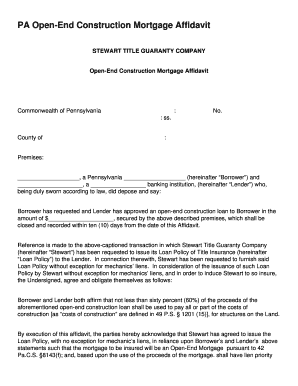

Fillable Online Pa Open End Construction Mortgage Affidavit Fax Email Print Pdffiller

Home Mortgage Disclosure Act Faqs Consumer Financial Protection Bureau

New Jersey Open End Mortgage Us Legal Forms

:max_bytes(150000):strip_icc()/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

:max_bytes(150000):strip_icc()/shutterstock_292433354.reverse.mortgage.cropped-5bfc31484cedfd0026c22351.jpg)

:max_bytes(150000):strip_icc()/shutterstock_188743595.home.equity.loan.cropped-5bfc30d1c9e77c0026b5f52e.jpg)

:max_bytes(150000):strip_icc()/Balance-Jess_Feldman_Headshot--2Rev-185dc0760b854afc8f177ef3f5d50f55.jpg)